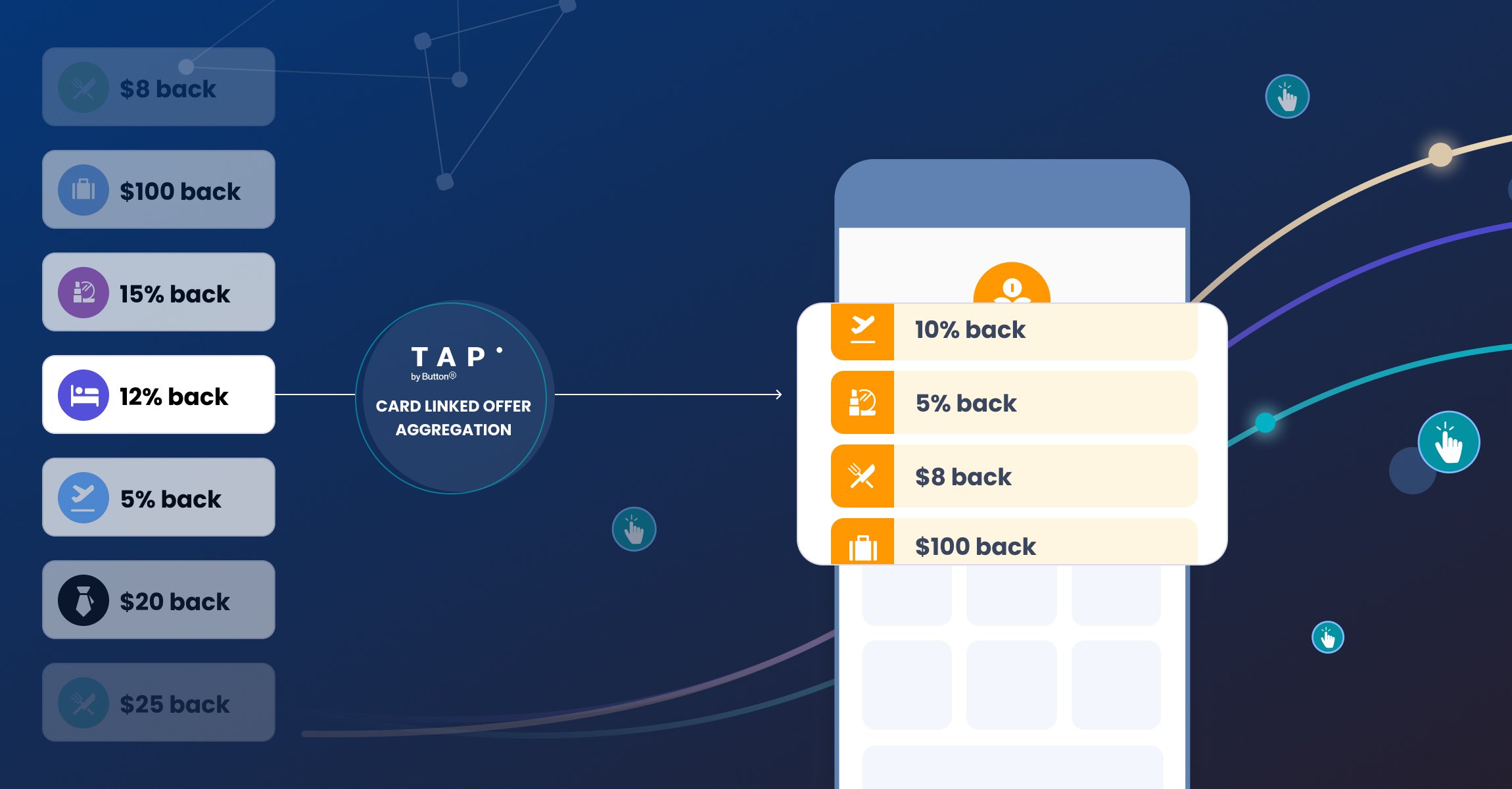

Tap, Button's fast growing mobile commerce product that enables fintechs to provide exclusive, personalized commerce content in their apps and sites, has launched a Card Linked Offer aggregation solution which enables customers to benefit from a wider range of retailer offers via a single integration.

Now customers of Tap, including Mastercard and their network of banking partners, will be able to offer users the ability to seamlessly shop online and in-store with the world's leading retailers. All of this will be possible through a single integration.

Button's integration with Kard and other third parties, more to be announced soon, allows Button's fintech partners to benefit from the unique brands multiple card linked offer aggregators provide - delivering the richest and most expansive collection of online and in-store offer content without the need for multiple costly integrations.

Tap, which recently surpassed 320M MAUs, started by providing online offers only - but with the growth in card linking and demand from the biggest fintechs in the US - has added this new solution. In response to the industry's dissatisfaction with outdated card linking systems, low quality offers, and a taxing integration model - Tap is providing a one stop shop that addresses all three issues.

"I am extremely excited by the partnerships we are announcing today, over the last 18 months Tap's Card Linking business has grown from 0 to 320M monthly active users," said Rob Berrisford, GM of Tap at Button. "Having great partners like Kard and others deliver great retailer and restaurant content enables our fintech partners to deploy the most exclusive personalized offer content with the fastest integration option in the market."

"We are incredibly excited by our new partnership with Button's Tap product, they allow us to get our brand offers to the market more quickly and their growing scale is providing Kard with great opportunities for growth," said Joe Doretti, VP partnerships at Kard.